“How in the world am I going to pay off my student loans?” This was the first thought I had when I received my official payment notice 6 months after graduating from college. Paying off your student loans can be so hard, and the absolute worst part is sticking to a payment plan long enough to actually reach your financial goal of $0 left!

I’ve so bene there. I obtained over $10,000 in student loans and never seemed to be able to make ends meet. Until finally, I learned the secrets of passive income, which is what I am sharing with you here!

In this blog post I’m sharing exactly how I paid off my student loans in just one year. I’ll be covering:

- How I paid off my student loans

- The start of my loan journey

- Understanding Interest on loan payments

- Deciding I needed to make more money

- Making the decision to try to pay off my student loans

So if you’re tired of struggling to make payments, falling off the wagon of every fincnial plan you start,

constantly feeling hungry and deprived, and still never reaching your goal savings amount, then you’re in

the right place! All of that is about to change for good!

How I paid off my student loans

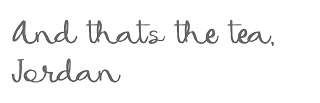

Four years after grduating, my student loans are officially paid off in full. I literally thought this accomplishment would take years to do and I managed to do it in 4 years. Surprisingly, amidst all of this COVID outrage, a bulk of the payments were made in 2020.

I feel very fortunate to have only left school with under $15,000 in student loans. I know that’s not the average $80,000 – $120,000 loans others have taken out, but I am still extremely proud. Money has been at the forefront of my mind ever since I got my first job. I’m of a budget mindset and I think it is one of my best qualities. I talk numbers and money doesn’t scare me.

The Start of my Loan Journey

I specifically picked a university in the state to keep my loans low. My mom did make a suggestion that I should get as much of the college experience as possible and stay at the dorms for my first year, even though I could have lived rent-free with my parents for my college years. I took her up on that. Well worth the funds in my opinion. Living in the dorms created a sense of indecency I always knew I had. At the same time, that is where a big chunk of my loan total came from.

It was $8,000 just for room and board for one year… with scholarships involved. We paid for the education portion out of pocket for the first two years. Everything after that was at the mercy of FASFA. I took out one more loan about halfway through my schooling. At this point, I was responsible for my education. Saving up money is something I take a lot of pride in so, I don’t like to touch my savings. Taking out a loan was obviously the better idea. *facepalm* Considering my only bills were my car insurance and car payment, I should have just paid the damn school fee but here we are!

Some of the schooling fees I had to pay along the way. Usually, when I made some extra commission or had some extra money to spend I would pop some money into my loan pot. I wasn’t THAT cruel to my future self, ha-ha.

Walking out of college in 2016 with a degree and a final amount of $11,315.12 in loans was major for me. They give you a 6 month grace period before you have to start making payments on your loans or enroll in school again. I started making the minimum payment 6 months after graduation which was $108 every month. This is where I want to kick myself.

Figuring out what Interest Actually Is

Guess how much of my $108 payment went to the principal and how much went to interest? $52.97 went towards interest and the rest went towards the principal. What kind of crap is that? Young and naive me, I never looked at that until this year. So for 3 years, I was making payments at $108 each month not realizing interest was eating up half of that. Ugh. Talk about frustrating.

In 2017, I got a job as an event coordinator at a nonprofit here in Las Vegas. I love my job, but working for a non-profit doesn’t exactly bring in bankrolls. At the same time I moved out on my own and got a new car to go along with my new job. I was in the process of leveling up my life. Unfortunately, my student loan monthly payment stayed the same because I was on a strict budget now.

Fast forward to 2020 and I was still making those same payments. By 2020, I had only paid off $4,963 on my loan. These payments were just annoying now. Three years later, I hadn’t seen a raise at my job since my first year and with COVID I wasn’t expecting one to come for me soon. I needed to make a change. I needed to get these paid off.

Nothing Changes if Nothing Changes

I partnered with an all-natural beauty company sharing beauty products on my social media, just to get an extra $200 a month. All I wanted was to bump my payment up to $300 a month. I did that for about 3 months and then COVID hit; that’s when everything froze. House payments, energy bills, car insurance offered some discounts to their customers, AND student loan interest froze. Mhmm. That meant everything I was paying was going STRAIGHT to the amount I owed and NOT the interest.

I remember this moment clearly. My mom texted me and said, “All student loan interest is frozen during the pandemic.” And I looked at my boyfriend, Rob and said ” I’m going to pay off my loans this year.”

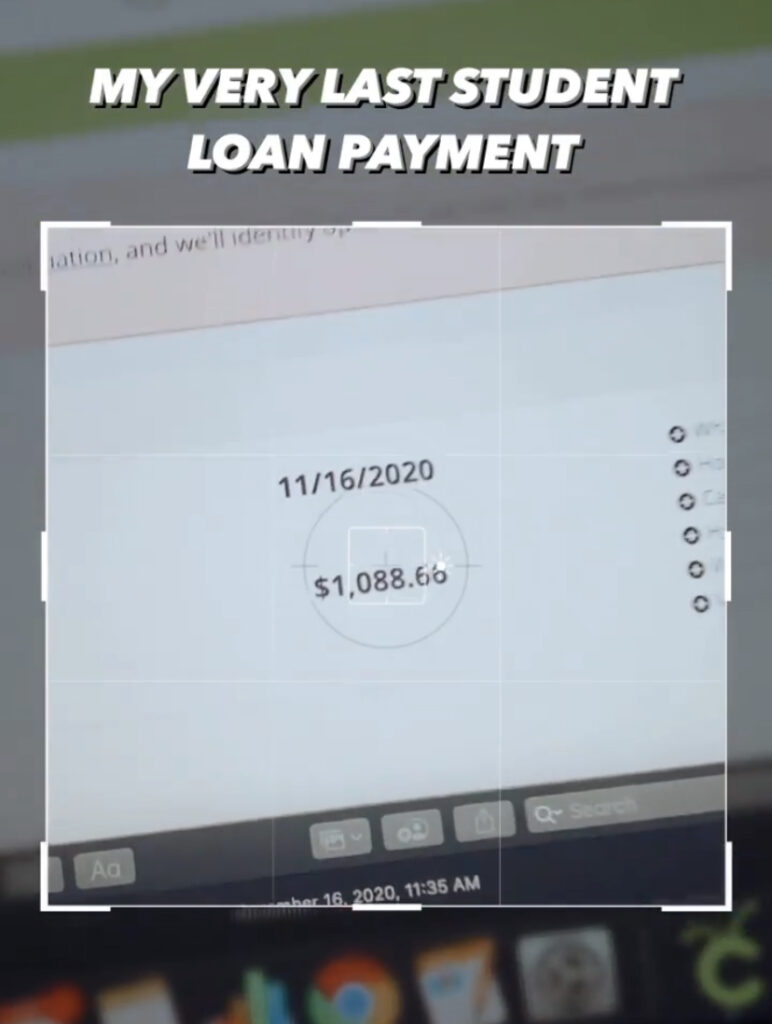

Every dime I made from Monat and anything extra I had to spare went straight to my student loans. My goal was to pay them off by November 2020. I was making $600-$1,000 payments every month with the extra income I had.

As much as I would’ve rather bought myself some clothes, or gone away for a weekend, it felt really good to be moving towards a debt-free lifestyle.

Every Accomplishment Starts with the Decision to Try

I am typing with so much glee that I was able to pay off my student loans in full in November 2020. It is so nice going into the holiday season knowing I can now put any and all extra funds towards my big goals. Things like traveling to all of my bucket list locations, putting a down payment on a home, maybe even retiring early. All of these sound like such wonderful goals. And if this big win is any indication of how my mindset is, I know I’ll achieve everything I want in life.

One Response

Congratulations, you amazing gal! What an accomplishment…I’m so proud of you. You’ve proven over and over again that you can do anything you set your heart and mind to do. Love you ❤️!!