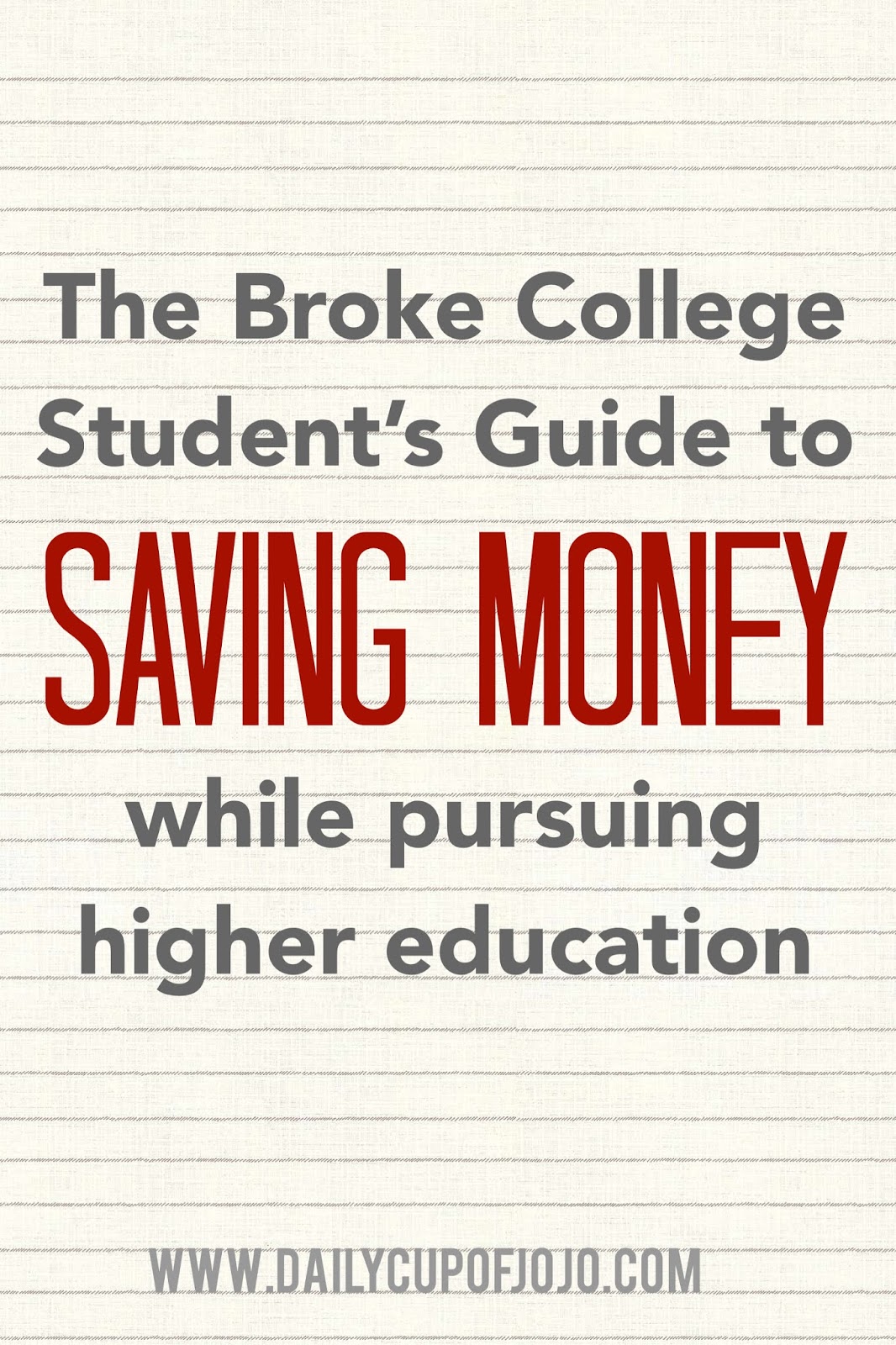

College is not for everyone. I think you all can level with me in understanding that higher education isn’t for all of us. There are people who will walk out of high school straight into a job that appeals to them on multiple levels – they may be offered good pay and chance for progression right away too. Some people just walk in the light yenno? For many of us though, enrolling in college is either the most convenient way to secure the job of our dreams or the only way to secure the job of our dreams. Increasing numbers of departments are requiring Bachelor’s degrees from their employees, and without the relevant qualifications (*cough cough* a degree), your resume will just be sifted into the trash can. At what cost is all of this hullabaloo worth though?

No matter how you go about it, studying for a degree is expensive. You have to cover the costs of tuition (at minimum), pay for your housing, your books, and food you eat in the process. The list goes on. Some are fortunate enough to have this paid for, some are able to work while pursuing a degree, but some degrees are so demanding you physically cannot work while in school. You’re just collecting debt at that point. There are ways to seriously cut the costs of your college expenses and to even save a little money away while you are studying too! Here are a few things I did to pay my way through school

Scholarships

You know what’s great? Free money. Money you don’t have to pay back. This is a great way to start riding off some of that college debt. I know, everyone groans about applying for scholarships but life gives you very few freebies, don’t blow them on scholarships. Write the essays. Think of it as getting paid to write because while you’re writing your essay, everyone else is groaning about it giving you a higher chance of being selected. I applied for scholarships right out of high school and ALL throughout college. There are plenty of resources on campus and online. Hell, I won a scholarship for explaining what I would do in the midst of a zombie apocalypse. I received $2,000 right there. There are some weird essay questions out there, you just have to find one that resonates with you.

Finding the Right Student Loan

Walking into the financial aid office is usually the last thing students want to do but the reality is the majority of students nowadays require a student loan. Hell, I required two even with help! College fees are on the rise Y’all. The average tuition fees for a standard four-year college course amount to $34,750 per year (that’s a brand new car or a boat in some instances). Room and board fees for a standard college total $12,210 YEARLY. Also, the approximate total cost of attending college for just one year, before any luxuries, is $46,950. That’s your first year’s salary straight to loans.

College could essentially wreck you and your savings but there are some loans that don’t prey on the flesh of young freshmen. Now, many people make the mistake of thinking that all student loans are the same and that they are interest-free. This isn’t true. A student loan will generally have an interest rate attached, meaning that the longer you leave paying it off, the more you will owe in the end. However, there are different providers out there, and you can make use of private student loan lenders who may offer you a preferable interest rate and terms and conditions. If this interests you, there is more information for you here.

Buy Textbooks Second Hand

You know those memes you see about textbooks in college, well, they’re true. Sometimes these books professors require you to have but don’t even reference it once are easily $100. No matter what course you take, chances are that you’re going to find yourself forking out a whole lot of money for textbooks. The publishers of these specific textbooks realize that they are necessary for students, and consequently hike their prices. Your college’s library may have one or two copies listed in their collection but if this is a book that is listed as essential for your course, there are going to be a whole lot of people trying to take it out at once. Generally speaking, if a book is recommended, you really could do with a copy of your own, so instead of paying full price for a brand new copy, consider browsing online auction sites for a copy. There will be numerous graduates who are clearing out after their degree and who will have listed the same book online for a much lower price. Amazon has some decent pricing or invest in a kindle so you can get the online version which will save you loads!

Get a roommate

Yes, living alone, away from the mess and noise of other students would be ideal, BUT this will significantly increase your living costs while in school. For the sake of your finances, it is worth considering house sharing. Dorms are always an option, but they’re expensive what with meal plans, all new materials and you get hardly any space. Sharing a house or an apartment will cut your living costs by a whole lot of money because you can split your bills. Finding a roommate can sometimes be the hardest part of this whole ordeal. You could try socializing on campus. You are bound to meet someone who leads a similar lifestyle to you. Alternatively, you can use student match sites that aim to buddy you up with potential housemates or roommates who you will get along well with. That’s how they pared me and my college roommate up and we did just fine!

Sure, college may be an extremely expensive experience all-round, but there are ways to reduce the costs that come in hand with obtaining a degree. You are more likely to earn more money with your degree, and by following the above steps, you should be able to cut the costs that allow you to reach this stage of your life!

Any other cost-saving tips and tricks I should know about? There is probably an app for all of this, but I’m old skool.

Daily Cup of JOJO is a part of some affiliate programs, meaning if you click and/or make a purchase from this site I may make a commission from it which I will use to buy unnecessary wall art, my Netflix subscription, and add to my scotch collection I haven’t started yet.